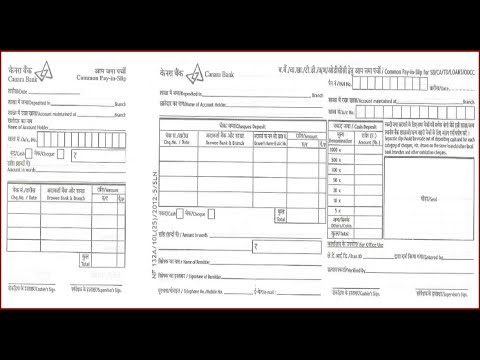

- Cheque Banking Information

- Cheque Bank Account Number

- Td Bank Cheque

- Cheque Bank And Transit Number

- Cheque Bank Muamalat

- Cheque Bank Numbers

If you have a checking or savings account at a federally insured bank, you should have no trouble cashing a check there.

But for the millions of people without a bank account, check cashing is not as easy. Approximately 8.4 million U.S. households, comprising 14.1 million adults, don't have a bank account, according to a 2017 survey from the Federal Deposit Insurance Corporation.

There are ways to cash a check without a bank account, but they cost more money, often require more time and involve more risk than check cashing at a bank where you have an account. Here are five options:

Save money, time and stress when you order cheques in Canada with Cheque Print Solutions. We offer up to 30% cost savings on the price of traditional bank cheques in Canada as well as 5-15% savings on products from other major Canadian cheque printers, on average. We will ship your products directly to you, for free., within only a few days. Inaam Personal Bank Account Gold Loan Savings Account: Two Cheque Books Free per quarter (20 leaves) Prime Salary Account Prime Plus Savings Account: Fee of Rs.50 per cheque book (20 leaves) is applicable beyond Free Limit: Prime Savings Account. The branch transit number, financial institution number, and bank account number are located at the bottom edge of your cheque. Branch transit numbers are always 5 digits long and financial institution numbers are always 3 digits long. Bank account numbers may be up to 12 digits long. Below is an example of a cheque.

1. Check cashing at the issuing bank

Banks and credit unions are not required to cash checks for non-customers, but many banks will cash a check payable to a non-customer if the check is written by an account holder at that bank.

There are a few requirements though. For one, there must be enough money in the account the check is written against to cover the check. The payee will need to show identification, such as a driver's license or military ID.

Cheque Banking Information

The payee also should expect to pay a fee. Check-cashing fees at traditional banks hover around $8. If you get paid 52 weeks a year, that's $416 in check-cashing charges.

And there may be restrictions, such as limits on check amounts and refusal of two-party personal checks. Checks that are six months old or more might be declined.

Freeroll slot tournaments online casino sites have gambling apps that cater to players that want to download the software onto their device. Alternatively, you can choose the. Free Slots Tournaments Online slots tournaments are becoming more and more popular and many casinos are offering them. They are a fun way to try various slots at a casino for a little or no cost. Moreover, they give players the chance to win some pretty. Play Free Online Slot Tournaments Freeroll slot tournaments are competitions where participants are not required to pay a deposit to take part. The casino lets you enter for free with a chance of winning real cash and cool prizes without risking any of your own money. Online casino free roll tournament.

2. Check cashing at a retailer

There are a number of big retail stores like Kmart, Walmart and grocery chains that offer check-cashing services.

The least expensive option is probably Kmart, if you can find one that hasn't closed. The struggling retailer charges only $1 or less to cash checks, including two-party personal checks up to $500. The caveat is that you need to be a member of the store's 'Shop Your Way' program to use the service. Joining the program is free.

Walmart charges $4 to cash checks up to $1,000 and up to $8 for checks more than that amount. Walmart also cashes two-party personal checks, but it limits them to $200 and charges a $6 max fee.

Grocery chains often provide check-cashing services. Kroger, Publix, Giant Eagle, Albertsons and Ingles, to name a few, cash checks. Fees typically range from about $3 to $6.

3. Loading funds onto a prepaid debit card

Video: 5 Things To Downsize Before You Retire (GOBankingRates)

People who don't have bank accounts sometimes use prepaid cards to deposit checks and access their cash. Prepaid cards are similar to checking account debit cards. Your spending is limited by how much money you have loaded onto the card.

Prepaid cards have different options for check cashing. Some prepaid cards let you set up direct deposit so that checks are automatically loaded onto the card. Other cards come with an app that lets you snap a picture of your check to load it onto your card. Or, you might be able to deposit your check at an ATM to load the money onto the card.

Fees are a big drawback of prepaid cards. The Walmart MoneyCard charges $2.50 to withdraw money at an ATM (not including the fee the bank charges) or a bank teller window, and 50 cents to check your card balance at an ATM. There is a monthly fee of $5.94 unless you load $1,000 a month onto the card.

Reload fees can be steep. It can cost you up to $5.95 to add money to a Green Dot Prepaid Visa card. Green Dot also charges a $3 ATM fee. Sometimes, prepaid card fees are scaled according to how quickly you want your money, and you can get dinged for expedited availability.

4. Cashing your check at a check-cashing outlet

Check-cashing outlets are probably the most expensive places to cash checks. Some of them require customers to become 'members' or to buy check-cashing ID cards before they will cash your checks. In addition to a membership fee, they might charge a first-time use fee.

Fees to cash a check can range from 1 percent to 12 percent of the face value of the check. That means you could pay from $10 to $120 to cash a $1,000 check. Some businesses charge a flat fee on top of the percentage.

The average face value of a check presented to a check-cashing outlet is $442.30, with the average fee to cash that check being $13.77, or about 3.1 percent, according to the FDIC. If that's your paycheck and you cash it every week, you'll pay $55.08 a month, or $661 a year, in check-cashing fees

Not only are check-cashing stores exorbitantly expensive, there is a risk of deceptive practices. The Better Business Bureau, for example, alerts consumers to a scam whereby customers of a check-cashing store are called by someone who claims to represent the business. The caller offers the customer a loan and requests payment to secure the loan. Of course, the loan is never received and the customer of the check-cashing store gets scammed out of some cash.

Check-cashing stores should be your last resort.

5. Sign your check over to someone you trust

Another way to cash a check if you don't have a bank account is to sign the check over to someone you trust who does have a bank account and have that person cash the check at their bank.

Make sure the person you want to sign it over to is willing to cash the check, and that his or her bank will cash it. You should accompany your trusted friend to the bank in case the teller requires your ID or has questions about the check.

The person must have the proper identification and be prepared to have his or her check dinged by a check-cashing fee. There is also a personal and financial safety risk. Paper checks and cash can be lost or stolen.

Bottom line

Turning that paper check into cash in your hands is trickier if you don't have a bank account. Unlike the consumer who has a bank account and direct deposit of their income, unbanked consumers almost have to plan ahead to cash their checks and access their money.

It's fairly easy to find a bank or other business that will cash your check if you don't have a bank account. But there will be fees and restrictions. And there are risks associated with carrying checks and cash.

The best way to cash checks is by opening a checking or savings account at a federally insured bank or credit union, then setting up direct deposit of your payroll check, tax refund, pension benefit and other income. Not only is it safer and easier, it will cost you less.

Related Articles

Cheque clearing (or check clearing in American English) or bank clearance is the process of moving cash (or its equivalent) from the bank on which a cheque is drawn to the bank in which it was deposited, usually accompanied by the movement of the cheque to the paying bank, either in the traditional physical paper form or digitally under a cheque truncation system. This process is called the clearing cycle and normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn, with a corresponding adjustment of accounts of the banks themselves. If there are not enough funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked as non-sufficient funds.[1]

History[edit]

England[edit]

Cheques came into use in England in the 1600s. The person to whom the cheque was drawn (the 'payee') could go to the drawer's bank ('the issuing bank') and present the cheque and receive payment. Before payment, the drawer's bank would check that the cheque was in order – e.g., that the signature was that of the drawer, that the date was valid, that the cheque was properly set out, etc. Alternatively, the payee could deposit the cheque with their own bank who would arrange for it to be presented to the issuing bank for payment.

Until around 1770 an informal exchange of cheques took place between London banks. Clerks of each bank visited all of the other banks to exchange cheques, whilst keeping a tally of balances between them until they settled with each other. Daily cheque clearings began around 1770 when the bank clerks met at the Six Bells, a tavern in Dove Court off Lombard Street in the City of London, to exchange all their cheques in one place and settle the balances in cash.[2]The first organization for clearing cheques was the Bankers' Clearing House, established in London in the early 19th century. It was founded by Lubbock's Bank on Lombard Street in a single room where clerks for London banks met each day to exchange cheques and settle accounts. In 1832 Charles Babbage, who was a friend of a founder of the Clearing House, published a book on mass production, The Economy of Machinery and Manufactures, in which Babbage described how the Clearing House operated:[3]

'In a large room in Lombard Street, about 30 clerks from the several London bankers take their stations, in alphabetical order, at desks placed round the room; each having a small open box by his side, and the name of the firm to which he belongs in large characters on the wall above his head. From time to time other clerks from every [banking] house enter the room, and passing along, drop into the box the cheques due by that firm to the house from which this distributor is sent.'

Beginning at 5 pm, a clerk for each debtor bank was called to go to a rostrum to pay in cash to the Inspector of the Clearing House the amount their bank owed to other banks on that day. After all of the debtor clerks had paid the Inspector, each clerk for the banks that were owed money went to the rostrum to collect the money owed to their bank. The total cash paid by the debtor banks equaled the total cash collected by the creditor banks. On the rare occasions when the total paid did not equal the total collected, other clerks working for the Inspector would examine the paper trail of documents so that the numerical errors could be found and corrected.[4]

Jumping forward several centuries, the Cheque and Credit Clearing Company is the United Kingdom's clearing house.

Cheque Bank Account Number

United States[edit]

The Suffolk Bank opened the first clearing house in 1818 in Boston, and one was incorporated in New York in 1850.[5] A clearing house for bankers was opened in Philadelphia in 1858.[6]

The Americans improved on the British check clearing system and opened a bankers' clearing house, the Clearing House Association, in the Bank of New York on Wall Street, New York in 1853. Instead of the slow London procedure in which each bank clerk, one at a time, stepped up to an Inspector's rostrum, in the New York procedure two bank clerks from each bank all worked simultaneously. One clerk from each bank sat inside a 70 foot long oval table, while the second clerk from each bank stood outside the table facing the other clerk from the same bank.[7] Each of the outside clerks carried a file box. When the manager signaled, all of the outside clerks stepped one position to the left, to face the next seated clerks. If a seated clerk represented a bank to which money was owed or from which money was receivable, the net amount of cash would change hands, along with checks and paper documents.

Thus several such transactions could be conducted simultaneously, across the oval table. When the manager signaled again, this procedure was repeated, so that after about six minutes, the clerks had completed all their assigned transactions and were back to their starting locations, and holding exactly the amount of cash their papers said they should be holding. Clerks were fined if they made errors and the amount of the fine increased rapidly as time passed.[7][8]

The Federal Reserve System check clearing system was established in the United States in 1913 to act as a central, well-capitalized clearing house. The objective was to prevent the occasional panics, where banks would refuse to accept cheques drawn on banks whose solvency was uncertain. The Federal Reserve can physically accept and transport cheques.[9]

Operation[edit]

When a bank customer deposits a cheque, which may be drawn on any bank, the bank would credit the depositor's account with the amount of the cheque. Coin master free spins link today facebook. However, the amount so credited is 'not available' to the depositor until the cheque has been cleared by the paying bank.

For cheques drawn on a customer of the same bank, the bank would, usually on the next business day, ensure that the cheque is in order and debit the account of the drawer, and the cheque would be taken to have been cleared. A cheque is not in order if, for example, the date is invalid, the drawer's signature is not like the one held by the bank, the wrong number of signatories have signed the cheque, etc. There must also be sufficient cleared funds in the account before the drawer's account is debited.

Cheques drawn on another bank (termed 'the issuing bank' or 'paying bank') need to be 'presented' to the other bank before the deposit bank receives payment to cover the amount credited to the depositor's account. In the absence of the paying bank notifying the deposit bank of the 'special clearance' of the cheque, for example, following a request from the deposit bank, the funds become available after the passing of an agreed 'clearance period', commonly three business days, when the depositor's account is described as comprising 'cleared funds'.

If the cheque is not in order, or if there are not enough cleared funds in the account when the cheque arrived at the issuing bank, the cheque would be returned as a dishonoured cheque marked appropriately, such as 'non-sufficient funds' or 'present again'.[1]

All banks might have clerks to take cheques drawn on other banks to those banks, and wait for payment. Clearing houses were set up to streamline the process by collected all cheques drawn on other banks, and collecting payment from those banks for the total to be cleared.

Automation[edit]

All banks might have clerks to take cheques drawn on other banks to those banks, and wait for payment. Clearing houses were set up to streamline the process by collected all cheques drawn on other banks, and collecting payment from those banks for the total to be cleared.

Automation[edit]

Cheque processing[edit]

As volume grew, more efficient sorting methods were developed. Approaching the 1940s, two popular methods were Sort-A-Matic and Top Tab Key. Sort-A-Matic involved a set of metal or leather dividers numbered 00 through 99, operated to implement a form of radix sort: cheques would be sorted by hand according to the first two digits. The cheques would be removed, and each stack sorted into the same dividers by the third and fourth digits. The process was iterated until the cheques were completely sorted. Top Tab Key used a physical mechanism: holes were punched in the top of each cheque representing the values of various digits, and metal keys used to physically move them until sorted.

Td Bank Cheque

Magnetic ink character recognition (MICR) was developed and commercialized in the 1950s, and enabled computers to reliably read routing and account numbers and automated the sorting of paper cheques.

Electronic clearance[edit]

Cheque truncation was introduced in various countries, starting in the 1990s, to allow electronic images to be made of physical cheques, for electronic clearance.

Cheque Bank And Transit Number

The legalisation of remote deposit made it possible for businesses and bank customers to deposit cheques without delivering them to their own banks. In the process, a depositor would make an image of the physical cheque with a smartphone or other device, and attach the image to a deposit. The deposit bank would use the cheque image in the normal electronic clearance process, though in this case MICR data would not be available.

Electronic payments[edit]

As the automation of cheque processing improved, fully electronic payment systems obviated the need for paper. Two methods were developed: the Automated Clearing House (ACH) for smaller payments which complete in two business days, and Clearing House Interbank Payments System (CHIPS) for larger value same day payments.

- 'In 1974, ACH Associations from California, Georgia, New England and the Upper Midwest region formed NACHA within the American Bankers Association. Following that, the initial ACH rules were approved, which made Prearranged Payment and Deposit or Direct Deposit, the first ACH transaction type, effective. By 1978, it was possible for two financial institutions located anywhere in the U.S. to exchange ACH payments under a common set of rules and procedures.'[10]

- 'The automated clearinghouse (ACH) system is a nationwide network through which depository institutions send each other batches of electronic credit and debit transfers. The direct deposit of payroll, social security benefits, and tax refunds are typical examples of ACH credit transfers. The direct debiting of mortgages and utility bills are typical examples of ACH debit transfers. While the ACH network was originally used to process mostly recurring payments, the network is today being used extensively to process one-time debit transfers, such as converted check payments and payments made over the telephone and Internet.'[11]

'CHIPS is the largest private-sector U.S.-dollar funds-transfer system in the world, clearing and settling an average of $1.5 trillion in cross-border and domestic payments daily. It combines best of two types of payments systems: the liquidity efficiency of a netting system and the intraday finality of a RTGS.'[12] Organized in 1970 by eight New York banks who were members of the Federal Reserve system, CHIPS competes with the Federal Reserve for high value payments. Until 2001, CHIPS settled at the end of the day, but now provides intraday payment finality through a real-time system.[13]

See also[edit]

- CHAPS - the UK equivalent of CHIPS

- Electronic funds transfer (EFT)

- The Electronic Check Council (ECC)

- NACHA - the US national ACH network

Cheque Bank Muamalat

References[edit]

- ^ ab'what is check clearing? - definition'. Business Directory. Retrieved August 21, 2014.

- ^Nevin and Davis, The London Clearing Banks, (1970) pp.40-41

- ^Campbell-Kelly, page 20

- ^Matthews, Philip W (1921). Bankers' clearing house: what it is and what it does. Banker's Library. Pitman.

- ^U.S. House of Representatives Banking and Currency Reform Hearings of the Subcommittee of the Committee on Banking and Currency, January 7, 1913, Part 1, Statements of A. Barton Hepburn, Victor Morawetz and Paul M. Warburg (1913) Washington, D.C.: Government Printing Office, p.388

- ^Blanchard, C. (Ed.) The Progressive Men of the Commonwealth of Pennsylvania (Vol. 2) (1900) Logansport, Indiana: A.W. Bowen & Co., p. 873

- ^ abCampbell-Kelly, page 21

- ^Campbell-Kelly, Martin (October 2010). 'Victorian Data Processing'. Communications of the ACM. 53 (10): 19–21. doi:10.1145/1831407.1831417.

- ^'Check Services Offerings'. Archived from the original on 2013-03-25. Retrieved 2013-03-27.

- ^'The Evollution of a Strong ACH Network'. NACHA. Retrieved 5 April 2017.

- ^'Automated Clearing House Services'. The Federal Reserve. Retrieved 5 April 2017.

- ^'CHIPS'. The Clearing House Association. Archived from the original on 2017-03-20. Retrieved 5 April 2017.

- ^'CHIPS'. Federal Reserve Bank of New York. Retrieved 5 April 2017.